Federal Tax Service taxpayer program. How to properly install, update and configure the Legal Entity Taxpayer program

Select category 1. Business law (230) 1.1. Instructions for starting a business (26) 1.2. Opening an individual entrepreneur (26) 1.3. Changes in the Unified State Register of Individual Entrepreneurs (4) 1.4. Closing an individual entrepreneur (5) 1.5. LLC (39) 1.5.1. Opening an LLC (27) 1.5.2. Changes in LLC (6) 1.5.3. Liquidation of LLC (5) 1.6. OKVED (31) 1.7. Licensing of business activities (12) 1.8. Cash discipline and accounting (69) 1.8.1. Payroll calculation (3) 1.8.2. Maternity payments (7) 1.8.3. Temporary disability benefit (11) 1.8.4. General issues accounting (8) 1.8.5. Inventory (13) 1.8.6. Cash discipline (13) 1.9. Business checks (14) 10. Online cash registers (9) 2. Entrepreneurship and taxes (398) 2.1. General tax issues (25) 2.10. Tax on professional income (6) 2.2. USN (44) 2.3. UTII (46) 2.3.1. Coefficient K2 (2) 2.4. BASIC (34) 2.4.1. VAT (17) 2.4.2. Personal income tax (6) 2.5. Patent system (24) 2.6. Trading fees (8) 2.7. Insurance premiums(58) 2.7.1. Extra-budgetary funds (9) 2.8. Reporting (82) 2.9. Tax benefits (71) 3. Useful programs and services (40) 3.1. Taxpayer legal entity (9) 3.2. Services Tax Ru (12) 3.3. Services pension reporting(4) 3.4. Business Pack (1) 3.5. Online calculators (3) 3.6. Online inspection (1) 4. State support for small businesses (6) 5. PERSONNEL (100) 5.1. Vacation (7) 5.10 Salary (5) 5.2. Maternity benefits (1) 5.3. Sick leave(7) 5.4. Dismissal (11) 5.5. General (21) 5.6. Local acts and personnel documents (8) 5.7. Occupational safety (8) 5.8. Hiring (3) 5.9. Foreign personnel (1) 6. Contractual relations (34) 6.1. Bank of agreements (15) 6.2. Conclusion of an agreement (9) 6.3. Additional agreements to the contract (2) 6.4. Termination of the contract (5) 6.5. Claims (3) 7. The legislative framework(37) 7.1. Explanations of the Ministry of Finance of Russia and the Federal Tax Service of Russia (15) 7.1.1. Types of activities on UTII (1) 7.2. Laws and regulations (12) 7.3. GOSTs and technical regulations (10) 8. Forms of documents (81) 8.1. Source documents(35) 8.2. Declarations (25) 8.3. Powers of attorney (5) 8.4. Application forms (11) 8.5. Decisions and protocols (2) 8.6. LLC charters (3) 9. Miscellaneous (24) 9.1. NEWS (4) 9.2. CRIMEA (5) 9.3. Lending (2) 9.4. Legal disputes (4) 1 question: During installation it was required reboot Windows, after which the program does not startAnswer: Run the installer again.

2. Question: During installation, the program asks for drive F (can be E, B, H ... ZAnswer: Apparently previous version installed from this disk. Create drive F, it doesn’t matter what will be on it (for example, connect any resource as drive F - my computer/connect network drive) and run the installer again.

3. Question: Is the data I entered in the “Legal Taxpayer” program deleted when installing a new version over the old one or when uninstalling the program?Answer: No. If you do not delete the folder where the program was installed, the installation program does not delete any entered data.

4. Question: After installation, I do not see the previously entered data (reporting forms)Answer: Everything is fine. Options:

1. You installed the program in the wrong folder:

On the computer where the program was installed, select the menu item in the NP LE program Service/Miscellaneous/Search for folders with the program;

After perhaps long work mode, a list of folders will appear where the program was ever installed and you worked with it;

In the list of found folders, you will see information about where the program was installed, when you last entered it, how many NPs were entered in it;

Remember the path to the option you need;

Uninstall the program - Start/Programs/Taxpayer Legal Entity/Uninstall a program;

Install the program according to the path you remember.

2. The entered data (reporting form) is in a different period from the current reporting period - this is resolved by changing the reporting period in the right top corner program windows;

3. Descriptions of reporting forms are not accepted; Check the availability of the required forms in the "Settings - Reporting Forms" mode; if not, download (the "Download" button).

5. Question: It is not possible to install Taxpayer Legal Entity with the installation program. What to do?Answer: You can install the “Legal Taxpayer” program “manually”. For this:

1. copy the folder INSTALL445\Taxpayer Legal Entity\ into c:\npul\ from the distribution kit

2. create a shortcut on the desktop to c:\npul\Inputdoc\inputdoc.exe

3. run the installation program "c:\npul\Print documents with PDF417(3.1.15).msi"

4. run the file c:\npul\reg.bat with administrator rights

Answer: the distribution files were damaged either when copied from an electronic medium or received via the Internet or as a result of a virus

If you downloaded the version online, check availability stable connection computer to the Internet and download installation package programs again

If the version was written to disk by the Federal Tax Service, try copying it from another computer or write it down again

7. Question: What should I do if, when installing the Legal Entity Taxpayer software, my computer reports the presence of viruses in the program?Answer: The Legal Entity Taxpayer software does not contain viruses, however, some installation files may be incorrectly classified by the anti-virus program as a suspicious object. Because antivirus program The user may perceive some installation files as a virus and not let them through; it is recommended that during installation and the first login to the program after installation, we recommend disabling antivirus software. In addition, the check slows down the program many times over and can even block its operation or the creation of a necessary file.

Solving problems that may arise during startup

1 question: After installation, when entering documents, a window appears asking for *.ocx files, click on the “Cancel” button and an error appears:"OLE error code 0x80040154: Class not registered. OLE object ignored. Record number 6"

"Internal error 2738"

Answer: Run the reg.bat file (may require running from an administrator) from the program folder (usually c:\Taxpayer Legal Entity\Inputdoc\reg.bat)

2. Question: when trying to start the program, messages like:

"Resource file version mismatch"

"The library MSVCR70.DLL was not found at the specified path..."

"Visual FoxPro library is missing"

Visual FoxPro cannot start

Could not load resources

Incorrect path or file name

Resource file version mismatch

Cannot locate the Microsoft Visual Foxpro support library

or the window goes out Microsoft Visual Foxpro and prg(fxp) file selection dialog

the program itself does not start

Answer:

1. if you launch using a shortcut on the desktop, make sure that the location where the Legal Entity Taxpayer program is installed matches the working folder in the properties of the program shortcut (for example:

- the program is installed in "C:\Taxpayer Legal Entity\"

- Object (Target): "C:\Taxpayer Legal Entity\INPUTDOC\inputdoc.exe"

- Working folder (Start in): "C:\Taxpayer Legal Entity\INPUTDOC\"

2. make sure that working folder there are files:

gdiplus.dll (1 607K)

msvcr71.dll (340K)

vfp9r.dll (4 600K)

vfp9rrus.dll (1 416K)

if they are not there, or the size does not match, disable antiviruses and run the version installation program again, select the “fix” option

3. try disabling the antivirus and running the program without it

4. perhaps in the windows\system32 folder there are files vfp9r.dll, vfp9rrus.dll, vfp9renu.dll, config.fpw - delete them from there and try to run the program

5. possible in the PATH environment variable (my computer/properties/advanced/button " Environment Variables") directory %SystemRoot%\system32 is present more than once - db once

3. Question: There are hieroglyphs in the program instead of letters, how can I fix it?Answer: 1. Set Russian on all tabs of the regional standards settings window (Control Panel/Language and Regional Standards) - pay attention to the language of programs that do not support Unicode on the Advanced tab - add “Russian”;

2. if it doesn’t help, load the classic scheme in the settings Windows screen;

3. if that doesn’t help, change the system language to English, reboot, then again into Russian and again reboot;

4.Attention! during shift windows languages may display a message stating that some files are already on the disk and suggests using them. Don't agree and select the file from the windows distribution. The point of these actions is to restore language files from the windows distribution.

1. Control Panel, Regional Standards, On the Formats tab, select the English format, on the Advanced tab (Language of programs that do not support Unicode), click the "Change system language" button, select English

2. Reboot!

3. Control panel, Regional standards, On the Formats tab, select the Russian format, on the Advanced tab (Language of programs that do not support Unicode), click the "Change system language" button, select Russian

4. Reboot!

5.Attention! sometimes the method helps on the second or third try

On some distributions windows change language may not help - there may be a problem with the ms sansserif font - download it and install it.

Windows 98, 2000, XP if that doesn't help:

Run the registry: "Start" - Run - "regedit"

Follow the path

HKEY_LOCAL_MACHINE\SYSTEM\CurrentControlSet\Control\Nls\CodePage

change the value of the string parameter "1252" from "c_1252.nls" to "c_1251.nls"

4. Question: Error message C0000005 appears... What should I do?

Answer: In the folder with the program, after such an error, there will be a file VFP9Rerr.log. Send it to [email protected]

5. Question: Sometimes an error occurs when accessing files located in temporary Windows folder (\Documents and Settings\...\Local Settings\Temp or \Users\...\Local Settings\Temp)

Answer:

-in this case, as a rule, it helps to either move the program’s temporary folder from “Documents and Settings” (for example, to c:\IDTMP\) - for this you need to set the environment variable IDWTEMP=c:\IDTMP\

This may be caused by the antivirus - try disabling it and working, if the error does not recur in the antivirus settings, exclude files like *.dbf, *.fpt, *.cdx, or the c:\IDTMP\ folder from the scan

Good afternoon dear friends! Today I want to tell you how to update the Taxpayer Legal Entity. This procedure is very important; the Federal Tax Service is constantly changing forms and report templates. Therefore, if you do not update the program in a timely manner, your report may simply not be accepted. Your report may be drawn up correctly, but because you have an old form, the tax office may simply reject the report. Let's get started!

How to update Taxpayer Legal Entity

If you are unable to decide on your own this problem, then you can go to the section and our specialists will help you.

Now let's find out which version we have. We launch the program and look at the program version in the header.

The version of the program is written after the words “Taxpayer Legal Entity”. IN in this case I have version 4.57. And the most latest version 4.57.1. So we need to update the Taxpayer.

How to correctly install versions of Taxpayer Legal Entity

Now very important point!!! In order for the update to be correct, the sequence of versions must be followed. The first step is to install the full version. Then, an additional version. The full version always consists of three digits. In this case these numbers are 4.57, the next full version will be 4.58, then 4.59 and so on. Additional versions consist of four digits. For example, now we will install version 4.57.1, then there will be 4.57.2, then 4.57.3 and so on. It happens that there are no additional versions at all or, on the contrary, there are many. Recently it happened that there was version 4.56.6. That is, there may be many additional versions, or there may not be any at all.

Now let’s look at which version to install on which. First of all, we always install the full version, then additional ones. For example: you have version 4.56.3, and now the latest is 4.57.1. This means that first of all we install version 4.57. Then we launch our “Taxpayer Legal Entity”, the database is re-indexed and only after that we install 4.57.1.

If you start installing version 4.57.1, and you have version 4.56.3, then the “Legal Taxpayer” program will not update for you, or it will not update correctly!

Even if you have version 4.54.1 or 4.56, you can safely install a higher version, such as 4.57. That is, higher FULL version, you can bet on ANY previous one.

Now let's look at additional versions.

How to correctly install additional versions of Taxpayer Legal Entities

Let's look at everything again using examples. Now we will install version 4.57.1. In the future, version 4.57.2 will be released (or maybe not).

Let's assume that we currently have version 4.56.1. So we install version 4.57 first, and then 4.57.1. But remember! After installing each version, you need to run the program so that the database is re-indexed; only after re-indexing can you update the program further.

Now let's look at another option. You have version 4.57, and the update is 4.57.3. In this case, you do not need to install versions 4.57.1 and 4.57.2, but immediately install version 4.57.3. All clear? If not, then questions in the comments.

Step-by-step instructions on how to update your Legal Entity Taxpayer

Theory is over! Now let's move on to the update process!

I have version 4.57, the latest version is 4.57.1. Download Last update Here . Let's unpack it. If you don’t know how to unpack a file, then read my article here.

Now we will definitely close the taxpayer legal entity program. Make sure a hundred times that you close the program. Otherwise you will lose all your data!

Let's launch the update. We see the “Welcome” window. Just click “Next”.

Now the most important step. We need to choose which folder to install the updates in. Click on the program shortcut right click mouse and select “File location”.

The folder with the Taxpayer will open. Let's look at the path. My Taxpayer is located at the path “C:\NP LE\INPUTDOC”.

You may have a different path! In the update program we need to specify this path, only without the “INPUTDOC” folder. Here I have the path “C:\NP LE\INPUTDOC”, which means during the update process I specify the path “C:\NP LE”. After specifying the path, click “Next”.

After this, the update process will begin. After the update is completed, a window like this will appear. Just click “Finish”

Immediately after the update, a window like this may appear. There is no need to panic, just click “This program is installed correctly.”

Now we launch our Taxpayer Legal Entity and see the re-indexing that I told you about. Just wait, without pressing anything, and without turning off the computer and the program, otherwise everything will break!

Now look again at the program header to make sure that the update was completed correctly and the latest version is installed.

We see that I now have version 4.57.1. So the update went well and correctly!

If you need professional help system administrator, to resolve this or any other issue, go to the section and our employees will help you.

Now you know how to update your Legal Entity Taxpayer.

If you have any questions, ask them in the comments! Good luck and good luck to everyone!

To be the first to receive all the news from our website!

Select category 1. Business law (229) 1.1. Instructions for starting a business (26) 1.2. Opening an individual entrepreneur (26) 1.3. Changes in the Unified State Register of Individual Entrepreneurs (4) 1.4. Closing an individual entrepreneur (5) 1.5. LLC (39) 1.5.1. Opening an LLC (27) 1.5.2. Changes in LLC (6) 1.5.3. Liquidation of LLC (5) 1.6. OKVED (31) 1.7. Licensing of business activities (11) 1.8. Cash discipline and accounting (69) 1.8.1. Payroll calculation (3) 1.8.2. Maternity payments (7) 1.8.3. Temporary disability benefit (11) 1.8.4. General accounting issues (8) 1.8.5. Inventory (13) 1.8.6. Cash discipline (13) 1.9. Business checks (14) 10. Online cash registers (9) 2. Entrepreneurship and taxes (397) 2.1. General tax issues (25) 2.10. Tax on professional income (5) 2.2. USN (44) 2.3. UTII (46) 2.3.1. Coefficient K2 (2) 2.4. BASIC (34) 2.4.1. VAT (17) 2.4.2. Personal income tax (6) 2.5. Patent system (24) 2.6. Trading fees (8) 2.7. Insurance premiums (58) 2.7.1. Extra-budgetary funds (9) 2.8. Reporting (82) 2.9. Tax benefits (71) 3. Useful programs and services (40) 3.1. Taxpayer legal entity (9) 3.2. Services Tax Ru (12) 3.3. Pension reporting services (4) 3.4. Business Pack (1) 3.5. Online calculators (3) 3.6. Online inspection (1) 4. State support for small businesses (6) 5. PERSONNEL (100) 5.1. Vacation (7) 5.10 Salary (5) 5.2. Maternity benefits (1) 5.3. Sick leave (7) 5.4. Dismissal (11) 5.5. General (21) 5.6. Local acts and personnel documents (8) 5.7. Occupational safety (8) 5.8. Hiring (3) 5.9. Foreign personnel (1) 6. Contractual relations (34) 6.1. Bank of agreements (15) 6.2. Conclusion of an agreement (9) 6.3. Additional agreements to the contract (2) 6.4. Termination of the contract (5) 6.5. Claims (3) 7. Legislative framework (37) 7.1. Explanations of the Ministry of Finance of Russia and the Federal Tax Service of Russia (15) 7.1.1. Types of activities on UTII (1) 7.2. Laws and regulations (12) 7.3. GOSTs and technical regulations (10) 8. Forms of documents (81) 8.1. Primary documents (35) 8.2. Declarations (25) 8.3. Powers of attorney (5) 8.4. Application forms (11) 8.5. Decisions and protocols (2) 8.6. LLC charters (3) 9. Miscellaneous (24) 9.1. NEWS (4) 9.2. CRIMEA (5) 9.3. Lending (2) 9.4. Legal disputes (4)This article will discuss correct order installing and updating the most popular program for entrepreneurs and accountants, “Legal Taxpayer”, which allows you to quickly and correctly fill out any tax return and reporting, formalize the opening/closing of an individual entrepreneur or LLC, switch to the simplified tax system or UTII, obtain a patent... And this is not a complete list of the capabilities of this program.

Introduction.

Despite the obvious advantages of using this software product, many entrepreneurs and accountants still fill out tax forms by hand on forms purchased from a print shop or downloaded from the Internet.

One of the reasons is the lack of a printer at home. “How can I print the declaration if there is no printer?” — the businessman rightly thinks. But it’s not difficult to get around this obstacle, just read this.

Others are intimidated by the complexity of installing and updating the program. We will deal with this problem today.

Where is the best place to download the program?

Officially, “Taxpayer Legal Entity” is distributed through the website of the tax service (www.nalog.ru) and the website of the program developer - Federal State Unitary Enterprise GNIVTs Federal Tax Service of Russia (www.gnivc.ru). Sometimes, during a large influx of visitors, these sites are unavailable, so here you will find both resources. It is not advisable to use other sources, because you can infect your computer with Trojan viruses or you will be scammed into paying for SMS.

At the time of writing current version is a taxpayer legal entity 4.46 dated February 10, 2016. As changes are made, additions No. 1, No. 2, No. 3, and so on will be released, and the version will look like 4.46.1, 4.46.2, 4.46.3. When there are a lot of changes, the developer will release new version- 4.47, and then this whole process will repeat.

Installation procedure

It doesn’t matter whether you are installing the program for the first time or you already have an older version installed, for example: 4.42.3, 4.44 or 4.45.2, you need to install the latest major version of the Legal Entity Taxpayer program, in our case this is 4.46 .

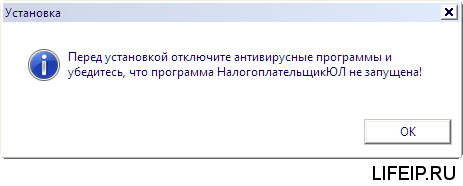

So, download the file NalogUL446.exe via the links provided above or from our website (which is the same thing). After this, the developers advise mandatory disable antivirus. It wouldn’t hurt to make an archive old version program (if available), so that in the case of unsuccessful installation program - restore all data.

Let's launch installation file- NalogUL446.exe. I forgot to disable the antivirus and immediately paid for it - the installer signaled that some files were not created. I had to add the file to the antivirus exceptions, turn off the antivirus, restart Windows 10, run the file as an administrator. And only after that the program began installation.

Turn off your antivirus before installing Taxpayer Legal Entity!

Turn off your antivirus before installing Taxpayer Legal Entity!

It will take some time to extract the files. After this you need to agree to the terms license agreement and click the “Next” button.

On next tab We indicate information about ourselves from the TIN and OGRNIP certificates.

Payers of the simplified tax system indicate their object of taxation, for example: “income” (6%).

Update procedure

The developer periodically releases small additions to the program, which correct identified shortcomings and also add new forms of tax reporting.

Such updates are called Change No. 1 (No. 2, No. 3, ...). They are installed on top of the main version, in our case 4.46. Those. First, the main version (4.46) must be installed, and then the necessary addition - 4.46.1 (4.46.2, ...).

Nuance. Each subsequent addition includes the previous one, for example: Change No. 2 already includes all the documents that were contained in Change No. 1.

Therefore, if you see that Current version program, for example: 4.46.3, then the installation order will be as follows: if version 4.46 is not installed, then install it first, always in the order described above, and then immediately Change No. 3, skipping No. 1 and 2.

The specified update procedure will be relevant for subsequent versions: 4.47, 4.48, 4.49 ...

At first glance, the installation and update procedure may seem a little confusing, but if you delve into it and figure it out, then in the future you will update “blindfolded” and will no longer be able to do without this amazing program, which I have been using for over 10 years.

If you have any questions, feel free to ask them below in the comments.

In the next article I will do short review the program's capabilities and answer basic questions about how to use it.