Daily expenses program for a computer. The best programs for home accounting

Use Home Accounting - a program for maintaining and controlling finances of both personal and family budgets. Available for computer and Android and iPhone/iPad mobile devices. Use synchronization and access recordings on your computer, smartphone and tablet.

In addition to accounting for personal finances and controlling the family budget, Home Accounting will help maintain financial records for individual entrepreneurs and small companies.

The program will allow you to create an effective financial plan, calculate income and expenses.

Complete control over your home finances!

Five reasons to start using Home Accounting today:

- Simplicity - No special accounting knowledge required

- Benefit - Keeping records of your household finances will help you achieve your goals.

- Benefit - By analyzing your budget, you can avoid unnecessary expenses

- Practicality - A complete set of functions necessary to control the family budget

- Safety - Password protection of records and database backup function

Features of Home Accounting

A program for tracking expenses and income of family budgets and personal finances

Keep records of your personal finances and the finances of all your family members. To ensure confidentiality, each user's records can be protected with a password.

Enter all your expenses and income into Home Accounting to keep your finances under complete control. Build your financial plans and create a budget.

Full control of loans and money lent, including control of their return with functions for calculating payment schedules and reminders.

The list of currencies in Home Accounting includes all the currencies of the world. Select the currencies you use.

The synchronization function allows you to exchange data with Home Accounting installed on another computer or on an Android, iPhone, iPad mobile device.

Home accounting helps you analyze your finances with a variety of reports and visual charts.

Import your bank statements into Home Accounting. If you need to transfer data from Home Accounting somewhere, the export function will help with this.

With a reliable backup system, be sure that your data is always completely safe and you will never lose it.

Reviews about Home Accounting

Home accounting is constantly used hundreds of thousands Human. Check out some reviews from our users.

Faith

Agapova

Great software! I’ve long wanted to try it for planning and managing a family budget – I’m pleased. It is possible to copy, synchronize both via cable and through the cloud. Home accounting has long become a reliable assistant in managing personal finances.

Catherine

Yatsenko

The best application of its kind for home accounting. Now I can quickly and competently draw up a personal financial plan and clearly see the movement of income and expenses. A big advantage is the ability to save your data, and I can easily keep track of my household finances from my tablet. I recommend it to anyone who wants to manage their personal finances safely and easily.

Alexander

Vakhramov

Great program! This is the best personal financial assistant for any family, full control of income and expenses, all personal data is saved, and I can use the program even from a tablet. Very useful for home accounting when there is not enough free time. I recommend it to everyone!

Olga

Honeypunk

Super program is the best tool that makes it easy to keep track of your household finances. I’ve been using it for 8 years now, my family’s accounting is under control. It was very helpful in correctly accounting for one’s own income and expenses and planning large purchases. Satisfied!

Alexander

Pavlov

Very convenient and useful application! The home accounting program helped not only in managing personal finances, but also in general financial planning for the family. Among the advantages, I would like to note complete control and reliability of personal finances. I recommend it to everyone for home bookkeeping.

Lyudmila

Potapova

I love this program very much, I’ve been using it “every penny” for 3.5 years. Maintaining home accounting helps you properly plan large purchases and control income and expenses. I consider the possibility of separate management of the family budget and control of personal finances to be a great advantage.

Alex

Apatenko

Home accounting is the best personal financial assistant! I started using Home Accounting to plan the purchase of a car, and eventually the whole family uses this program to manage household finances. A big plus is considered to be the security of personal finances and the ability to manage and control personal income and expenses for each family member. Thanks for the great program!

Nina

Bogdanova

Great software! I’ve been wanting to try it for a long time - I’m happy with the synchronization via both the cord and the dropbox. There is a possibility of backup, full control of income and expenses. The Home Accounting program has greatly helped in financial planning not only for the family budget, but also for the personal one. I recommend!

Albert

Khuzhakhmetov

The home accounting program helped me not only control my family’s income and expenses, but also properly organize planning at work. Simple management, the ability to easily manage personal finances - my whole family has already appreciated these advantages! I recommend home accounting to everyone, it’s an excellent program!

Salaries are paid regularly, but there is never any money. Many of our compatriots will agree with this statement. What is the problem - low wages or the inability to properly distribute personal funds? Let's try to figure out how to do home accounting and learn to control your family's finances.

Pros of Home Financial Planning

At first glance, home bookkeeping may seem like a boring and routine task. Constantly collecting all receipts and recording expenses is unusual for those who have never thought about their own expenses before. But in reality, financial planning is the key to stability and prosperity. Once you start recording your expenses and income, you can quickly find the answer to the question: “Where does the money go?” And rational distribution of funds and savings will help you save up for large purchases and get rid of debts. A home budget is a financial planning tool accessible to everyone. With its help, you can learn to save money, give up spontaneous acquisitions and gain financial independence. How to conduct home accounting correctly and effectively?

Common options for organizing a family budget

The most common are three forms of family budget. This is a general, partially shared or separate budget. The classic option for distributing funds in many families in our country is common family money. This system assumes that all earned funds are kept by one of the spouses, and he is also responsible for their distribution and spending. Most often, with such a budget organization, the wife manages the money. The main disadvantage of this option is the increased financial responsibility (for the distribution of funds) of one of the spouses. At the same time, most often, most of the household responsibilities fall on the shoulders of the one who manages cash flows. Young couples often choose a separate budget. In this case, each spouse manages their personal income, while allocating a portion for common needs. This option is not bad, but only if both husband and wife work and have a stable income. The most democratic form of family budget: partially shared. There are two varieties of it. In the first case, most of the funds earned by the spouses are added to a common piggy bank and spent in accordance with the needs of the family. At the same time, everyone still has enough finances to manage personally. In the second case, most of the spouses’ salaries are spent on basic household expenses. The money earned by the second of the pair (smaller salary) is postponed. Both options are a completely suitable basis for competent financial planning. How to properly conduct home accounting, who should manage money in the family? Each couple must find the answer to this question directly for themselves. All of the home budget options described above are acceptable and have a right to exist.

Home Accounting Tools

How to do home accounting: in a notebook, in a computer program or on your personal smartphone? It all depends on your lifestyle and personal preferences. The classic format is a ledger. This is a notebook, notepad or barn book, pre-lined for the number of expense items. In this case, the budget is filled out by hand. You will need pens (it is more convenient to use at least 2 colors). It is useful to keep your ledger along with a calculator for ease and speed of calculations. An alternative option will appeal to fans of electronic documentation. The well-known Microsoft Office Excel program was created specifically for working with tables. It is not difficult to master even for an inexperienced PC user. How to do home accounting in Excel, are there any nuances? No, everything is just the same as in a paper notebook - you just need to create a table of the appropriate size. Today, private financial planning is a hot topic. If you wish, it is easy to find special applications for PCs and smartphones, as well as online services designed for maintaining a home budget. Many users find them incredibly convenient. Often, such programs actually have nice additions in the form of shopping lists, reminders, and automatic summing up of the month.

Basic rules for maintaining a home budget

What do you need to know about accounting to successfully apply its principles in everyday life? The first rule is regularity. Record all expenses regularly. Not all of us have the opportunity to fill out financial spreadsheets every day. However, this must be done at least once every 2 days. If you keep records less often, you are likely to forget a significant portion of small expenses. Financial planners recommend not to miss a single detail. Often, such “small” expenses as payment for travel on public transport, ice cream and coffee on the way home make up a significant part of any expense item.

How to fill out the income section correctly?

The first and quite important section of the home budget is family income. All funds received by family members are recorded here. These are salaries, social benefits, interest on investments. Don't forget about one-time income. Bonuses, personal financial gifts, and compensation payments must also be recorded. Even if you win the lottery or accidentally find a bill on the street, be sure to record the amount received in the income section. It turns out that everything can be divided into stable and one-time ones. Of course, when planning financially, you should rely on the first category.

Main expense items

The most significant expense item is monthly payments. Each independent person pays monthly bills for utilities, Internet and telephony, and education. Usually these are fixed amounts. If we do home accounting, all regular monthly payments can be placed in one column. Many modern people spend personal finances on additional education or self-development. Should you include the cost of a fitness center membership or language course in your monthly payments? If there are no more than 3 items of similar expenses, it is logical to write them down in the same section. If there are a larger number of paid educational services, it makes sense to include them in a separate column. The next broad section of the home budget is food. How many columns should there be in the table? How to do home accounting correctly? It all depends on the needs and habits of the family. Expense items that are standard for most: home, clothing, household chemicals, medicines, entertainment, hobbies, gifts. If the family has children or pets, you can also allocate a separate spending section for each of them. You will understand how many sections your budget should have as soon as you start maintaining it. Don't forget to include a "Miscellaneous" column. It will be possible to record all forgotten expenses, as well as expenses that cannot be classified according to the chosen classification.

Will the home budget fit?

It is enough to record your expenses for 1-2 months, and you will be able to understand where the funds in your family go. Most of our compatriots, who are unaware of this, can only name the amounts of monthly payments with confidence. And this is already important data for analysis. If expenses for utilities and other mandatory monthly contributions exceed half of the family income, this is a reason to think about looking for a part-time job or changing your main job. In cases where this is not possible, you should try to apply for subsidies. For many categories of beneficiaries, social discounts are provided for utility bills and children's education. Be sure to regularly summarize your budget and analyze the rationality of your spending. You already know how to do home accounting. A PC program created to control personal expenses can read all entered data automatically. If you keep a home budget in a notebook, you will have to use a calculator.

Principles of rational economy

Maintaining home accounting will allow you to be more conscious about spending. How to save without compromising your quality of life? One of the extensive expense items is food. You can really save on food if you always prepare a sample menu and lists of necessary purchases in advance. Compare prices in different stores, make purchases at wholesale stores. You can also save a lot of money on purchasing clothes by visiting seasonal sales and giving preference to items from past collections. Try to give up impulse purchases, try to plan every trip to the store in advance.

How to do home accounting in a notebook: sample filling

We present to your attention a sample template for maintaining home accounting in paper form. You can draw the same table in your ledger or change it slightly. According to some experts, it is much more convenient to arrange fixed expense items in the form of vertical columns and fill them out as financial transactions are carried out. This is just one of the options for doing home accounting in a notebook. The example given at the beginning of this paragraph is best suited for a young family or a solo financial planner. If the budget is drawn up for spouses who have at least one child, the vertical arrangement of the columns is most relevant.

Conclusion

We tried to explain in as much detail as possible what home accounting is. How to manage, a sample table, options for organizing a family budget - all this is presented in our review. Maybe it's time to start recording all your income and expenses today?

Looking for free home accounting software? Then you've come to the right place.

Maintaining home accounting is the success of maintaining wealth in the family.

You can control your income and expenses the old fashioned way, i.e. in a notebook, and using modern methods, by installing the appropriate software on a PC.

In particular, we will consider the 5 most convenient and widespread programs for these purposes.

- HomeBank;

- Family Budget Lite;

- Family Accounting;

- CashFly;

- Home Accounting Lite.

HomeBank

A free application that allows you to keep track of your finances.

Using the software, you can fully control your income and expenses, plan your family budget, analyze expenses and more. Take complete control of your spending.

The program supports tight integration and import of data from Microsoft Money and Quicken services, as well as other applications for managing your own funds.

Supports QIF, QFX, CSV and OFX formats.

The functions include detection of duplicate transactions. This allows you to avoid confusion in calculations and clutter in the database.

Note! Transactions can be organized into categories. You can also schedule the automatic addition of incoming transactions to the created database, adding various tags and more. There is also a function that allows you to edit several fields at once, which significantly speeds up and simplifies the accounting process.

Set annual or monthly budget levels for each category as needed.

Generate dynamic reporting that reflects the current state of your financial situation. If necessary, they can be provided with diagrams for clarity.

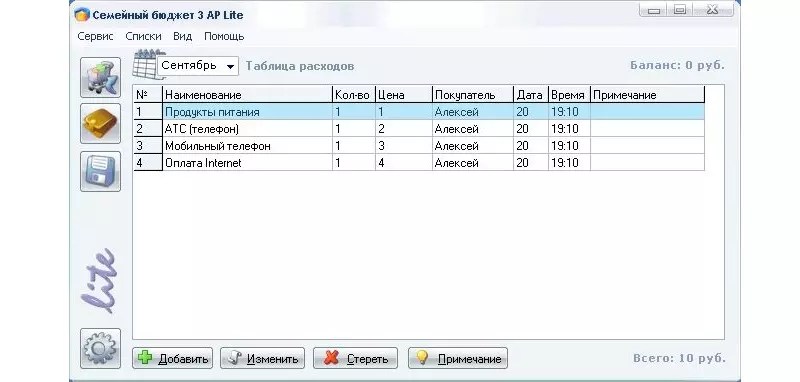

Family Budget Lite

This program is designed to relieve your pain in terms of counting personal expenses. All you need to do is enter your own income and expenses in the appropriate columns.

The program will perform all other operations independently.

The client benefits are as follows:

- profitability for several main categories and accounts is taken into account;

- you can account for your own debts, loans, investments, deposits and other calculations;

- you can use the auto-category function, i.e. when entering product names, the program will automatically select the required category from the table;

- detailed report of 8 parts in one click;

- export to HTML, BMP, TXT, Word and . It is also possible to print and save the document.

The client can be used by several people at the same time. In this case, everyone will have their own account and password.

The latter can be installed when the application starts.

Searching for income and expenses is very convenient, since it is possible to customize the results using several filters at once: product, date, category, etc.

Accounting Family

If you don't want to systematically wonder where your money is constantly going, use this program.

You don’t have to speculate and remember where the money went, which was put aside for so long for an important purchase, but at a critical moment it took it and evaporated in the literal sense of the word.

The program will allow you not only to analyze, but also to control your revenue. You will also be able to plan your own expenses by thinking through your budget more carefully.

The client has enough options:

- accounting of income and expenses;

- accounting of debts (both borrowed and borrowed);

- analysis of financial transactions;

- Possibility of accounting in different currencies.

CashFly is a simple and very user-friendly program for recording personal financial transactions.

You can create multi-level structures that display income and expense items.

It is also possible to build charts of varying degrees of complexity, based on previously entered data and other financial information important to you.

There is an address book, a list of organizations, and a personal diary that allows you to record reminders about events that are important to you.

The application is capable of keeping records in almost any given currency, performing scheduled calculation operations and printing data.

Databases are password protected for greater reliability and security of content.

It's decided! We begin to keep track of expenses and income. How? Some write them down in a notebook, others keep a table in Excel, and we advise you to download a convenient free program to your mobile phone. We already talked about them earlier, but now we decided to expand on this topic.

The team at Platiza, an online service for instant financial assistance, tested several of the very best programs for managing personal finances and prepared a fresh review especially for you, dear readers.

UPD This review presents applications into which you need to enter data yourself. However, more recently, a mobile application for Android has appeared - Balance, which automatically calculates your total balance, expenses for the current month and a forecast for the balance. To do this, you just need to upload your bank card data into it with the SMS notification service connected to it. Modern technologies based on artificial intelligence will make personal finance accounting easier and more convenient.

1) The simplest thing is Wallet

A very simple application, designed in a minimalist style. It is convenient and easy to use. If you have money, click “plus” and enter the required amount; if you have spent it, select “minus”. The amount in the middle is the total for the current account. You can create as many such accounts as you like. The program is perfect for beginners.

Pros:

Password protection

Quick accounting of expenses and income

Ability to add photo, audio and location

Clear final balance

Minuses:

No distribution of funds by day

No detailed statistics and graphs

Available on iOS only, no Android version

Supports: iOS

The application is used by several people from our team: an analyst, a PR manager and a technical director. Rating 5 out of 5.

2) The most caring thing - Zen Mani

The application will help you plan payments, create a budget and set financial goals. The main difference from others is that it recognizes SMS from banks.

Pros:

Recognizes SMS messages from banks, and you can enter transactions manually

Integrates with electronic money systems like Webmoney and Yandex.Money

Can work offline and download changes when connected to the network

Minuses:

Does not show total costs for the current day on the “statistics” tab

Supports: Android, iOS and PC.

Our programmer Zhenya has been using this application for several months and is very pleased, rating 4.5 out of 5.

3) The most advanced - EasyFinance

The service makes it possible to create several accounts and link them to bank cards. Category lists and currencies can be customized. Allows you to set financial goals (“apartment”, “car”, “vacation”) and monitor their implementation: the service gives recommendations if you too rarely save money for one of the planned large purchases.

Pros:

Automatic synchronization of transactions via SMS

Convenient budget and goal planning

You can enter the operation offline

There is a “loans” tab

Minuses:

Most useful services are paid

No multiplayer mode

Supports: iOS, Android

Our marketer likes the application, rating 4.8 out of 5.

4) The most intuitive - Where is the Money

A beautiful animated application, before starting use it offers you to familiarize yourself with a demo version of the wallet, which is very convenient for beginners. There are popular categories, but you can create your own.

Pros:

Unlimited number of accounts

Quick overview of the current period on the summary screen

Protect access to data via password (touch ID support)

Minuses:

Full control over the creation of categories and subcategories

Supports: iOS only

The web designer and system administrator like it. Rating 4.7 out of 5.

5) The most gaming - CoinKeeper

An application for accounting for personal finances with large colorful icons, convenient statistics graphs and a clear interface. Expenses are entered in this way: you need to move a coin on the screen from one field to another. The “automatic budget” function allows the program to calculate the main categories of expenses for the month.

Pros:

You can set reminders for recurring expenses

Family sharing across multiple devices

Sends notifications with reminders

Beautiful statistics, bright and visual diagrams

Financial goals help you save for the things you dream of.

Minuses:

The interface seems complicated at first glance

Supports: iOS, Android

Olya, a specialist in collecting overdue debts, recommends this application. Rating 4.5 out of 5.

6) The funniest thing - Toshl

Expenses can be tracked by categories, which you can configure yourself using a tag system. The application has an assistant, a three-eyed alien, he gives quite funny tips, warning about a possible budget overrun: “There may not be enough money! Pull yourself together."

Pros:

Reminds you every day that you need to budget at a certain time, which you can set yourself.

Beautiful graphics, funny characters

Supports data export

Minuses:

Registration is required, but it is simple and fast

Tags are entered manually

Many additional features are paid

Supports: iOS, Android, Windows Phone

Our tester uses the application. Rating 5 out of 5.

7) The most convenient - Budget

The application differs from all others in that it allows you to indicate monthly income and displays the remaining amount for the day, taking into account regular and planned payments. If the amount per day is exceeded, the remaining money is recalculated, and the amount per day is reduced accordingly. Very clear. Disciplines not to go beyond the daily budget.

Pros:

Nothing extra, the application is not overloaded

It’s clear exactly how much is left for the day

You can enter all your monthly expenses, the application will calculate everything automatically

Sends reminders

Minuses:

Does not allow you to set salary receipt dates

Supports: iOS

The project manager has been using this application for six months. Everything suits me. Rating 4.5 out of 5.

8) The most obvious - M8 - my money

Are you used to spending several hundred rubles a day on various nonsense? Using this application, you will understand that by saving on chocolates, you could buy yourself something more or less worthwhile. Small expenses add up to a large number. The pie chart clearly shows where you spend most of your income: on transport or, for example, food.

Pros:

Clear and simple interface

Minuses:

— there is no option to indicate expenses for the last month

- no accounting of income, only expenses

Supports: iOS, Android

The application is used by our Quality Assurance Manager. Rating 3 out of 5.

Do you keep financial records? If yes, then how? Share your experience in the comments with us and other readers.

Applications for tracking expenses and income will allow you to monitor your spending. Everyone has experienced the feeling that yesterday your wallet was full, but today there is only one lonely piece of paper in it. Therefore, in order to know when and how much you spent, this section contains special tools for budget planning. Now you can correctly balance your expenses and income directly from your Android phone without unnecessary hassle. In this section you can download programs for accounting expenses and income accounting absolutely free of charge without registration or SMS.

10.07.2018

Wallet- personal finance, budget, banks and charts will help users manage their money, take into account expenses and income. Android wallet will help you create a dynamic financial plan. You can find out where more money is spent and try to save money in order to achieve your goal and buy an expensive purchase.

07.09.2016

07.09.2016

CoinKeeper- a convenient way to take control of your expenses and income. The application is suitable for those who like to do home accounting, for those who want to be aware of their financial capabilities. By controlling your expenses and income, you can plan your budget and save for something worthwhile. What do you want to purchase?

22.07.2016

22.07.2016

Money Lover expense accounting– a program that will competently coordinate your finances. Using an electronic wallet, you can record your expenses and keep a history of your income. The utility has several reporting periods, which optimizes regulation and balance assessment. Join millions of happy users who have achieved maximum savings with Money Lover.

20.07.2016

20.07.2016

Monefy - convenient expense accounting– a great manager for maintaining financial history with many nice bonuses. The wallet has the simplest and most intuitive interface. All tools and functions are as accessible and intuitive as possible. Setting up the program takes less than half a minute.

19.07.2016

19.07.2016

AndroMoney- one of the most effective and simple applications for calculating the balance of money in your wallet. The effectiveness of the utility lies in the speed of all its tools, as well as in the competent sorting of categories. The Financial Activity Companion will always tell you the right way to organize your budget.

14.07.2016

14.07.2016