“Where is the money, Zin?” Three free programs for home accounting. Home accounting online

Use Home Accounting - a program for maintaining and controlling finances of both personal and family budgets. Available for computer and Android and iPhone/iPad mobile devices. Use synchronization and access recordings on your computer, smartphone and tablet.

In addition to accounting for personal finances and controlling the family budget, Home Accounting will help maintain financial records for individual entrepreneurs and small companies.

The program will allow you to create an effective financial plan, calculate income and expenses.

Complete control over your home finances!

Five reasons to start using Home Accounting today:

- Simplicity - No special accounting knowledge required

- Benefit - Keeping records of your household finances will help you achieve your goals.

- Benefit - By analyzing your budget, you can avoid unnecessary expenses

- Practicality - A complete set of functions necessary to control the family budget

- Safety - Password protection of records and database backup function

Features of Home Accounting

A program for tracking expenses and income of family budgets and personal finances

Keep records of your personal finances and the finances of all your family members. To ensure confidentiality, each user's records can be protected with a password.

Enter all your expenses and income into Home Accounting to keep your finances under complete control. Build your financial plans and create a budget.

Full control of loans and money lent, including control of their return with functions for calculating payment schedules and reminders.

The list of currencies in Home Accounting includes all the currencies of the world. Select the currencies you use.

The synchronization function allows you to exchange data with Home Accounting installed on another computer or on an Android, iPhone, iPad mobile device.

Home accounting helps you analyze your finances with a variety of reports and visual charts.

Import your bank statements into Home Accounting. If you need to transfer data from Home Accounting somewhere, the export function will help with this.

With a reliable backup system, be sure that your data is always completely safe and you will never lose it.

Reviews about Home Accounting

Home accounting is constantly used hundreds of thousands Human. Check out some reviews from our users.

Olga

Honeypunk

Super program is the best tool that makes it easy to keep track of your household finances. I’ve been using it for 8 years now, my family’s accounting is under control. It was very helpful in correctly accounting for one’s own income and expenses and planning large purchases. Satisfied!

Alexander

Nesterov

Great app. I have been using it for home accounting for 8 years now, and I can note the wide functionality and ease of management. It takes me a minimum of time to keep track of my household finances; backup allows you to save your data. Satisfied!

Catherine

Yatsenko

The best application of its kind for home accounting. Now I can quickly and competently draw up a personal financial plan and clearly see the movement of income and expenses. A big advantage is the ability to save your data, and I can easily keep track of my household finances from my tablet. I recommend it to anyone who wants to manage personal finances safely and easily.

Very convenient and useful application! A home accounting program will teach everyone how to correctly and easily manage personal finances and keep track of personal expenses.

Alexander

Vakhramov

Great program! This is the best personal financial assistant for any family, full control of income and expenses, all personal data is saved, and I can use the program even from a tablet. Very useful for home accounting when there is not enough free time. I recommend it to everyone!

Alex

Apatenko

Home accounting is the best personal financial assistant! I started using Home Accounting to plan the purchase of a car, and eventually the whole family uses this program to manage household finances. A big plus is considered to be the security of personal finances and the ability to manage and control personal income and expenses for each family member. Thanks for the great program!

Alexander

Pavlov

Very convenient and useful application! The home accounting program helped not only in managing personal finances, but also in general financial planning for the family. Among the advantages, I would like to note complete control and reliability of personal finances. I recommend it to everyone for home bookkeeping.

Lyudmila

Potapova

I love this program very much, I’ve been using it “every penny” for 3.5 years. Maintaining home accounting helps you properly plan large purchases and control income and expenses. I consider the possibility of separate management of the family budget and control of personal finances to be a great advantage.

Nina

Bogdanova

Great software! I’ve been wanting to try it for a long time - I’m happy with the synchronization via both the cord and the dropbox. There is a possibility of backup, full control of income and expenses. The Home Accounting program has greatly helped in financial planning not only for the family budget, but also for the personal one. I recommend!

Looking for free home accounting software? Then you've come to the right place.

Maintaining home accounting is the success of maintaining wealth in the family.

You can control your income and expenses the old fashioned way, i.e. in a notebook, and using modern methods, by installing the appropriate software on a PC.

In particular, we will consider the 5 most convenient and widespread programs for these purposes.

- HomeBank;

- Family Budget Lite;

- Family Accounting;

- CashFly;

- Home Accounting Lite.

HomeBank

A free application that allows you to keep track of your finances.

Using the software, you can fully control your income and expenses, plan your family budget, analyze expenses and more. Take complete control of your spending.

The program supports tight integration and import of data from Microsoft Money and Quicken services, as well as other applications for managing your own funds.

Supports QIF, QFX, CSV and OFX formats.

The functions include detection of duplicate transactions. This allows you to avoid confusion in calculations and clutter in the database.

Note! Transactions can be organized into categories. You can also schedule the automatic addition of incoming transactions to the created database, adding various tags and more. There is also a function that allows you to edit several fields at once, which significantly speeds up and simplifies the accounting process.

Set annual or monthly budget levels for each category as needed.

Generate dynamic reporting that reflects the current state of your financial situation. If necessary, they can be provided with diagrams for clarity.

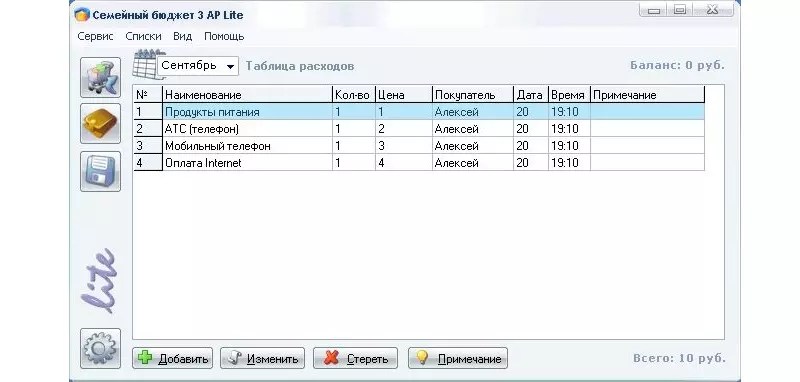

Family Budget Lite

This program is designed to relieve your pain in terms of counting personal expenses. All you have to do is enter your own income and expenses in the appropriate columns.

The program will perform all other operations independently.

The client benefits are as follows:

- profitability for several main categories and accounts is taken into account;

- you can account for your own debts, loans, investments, deposits and other calculations;

- you can use the auto-category function, i.e. when entering product names, the program will automatically select the required category from the table;

- detailed report of 8 parts in one click;

- export to HTML, BMP, TXT, Word and . It is also possible to print and save the document.

The client can be used by several people at the same time. In this case, everyone will have their own account and password.

The latter can be installed when the application starts.

Searching for income and expenses is very convenient, since it is possible to customize the results using several filters at once: product, date, category, etc.

Accounting Family

If you don't want to systematically wonder where your money is constantly going, use this program.

You don’t have to speculate and remember where the money went, which was put aside for so long for an important purchase, but at a critical moment it took it and evaporated in the literal sense of the word.

The program will allow you not only to analyze, but also to control revenue. You will also be able to plan your own expenses by thinking through your budget more carefully.

The client has enough options:

- accounting of income and expenses;

- accounting of debts (both borrowed and borrowed);

- analysis of financial transactions;

- Possibility of accounting in different currencies.

CashFly is a simple and very user-friendly program for recording personal financial transactions.

You can create multi-level structures displaying income and expense items.

It is also possible to build charts of varying degrees of complexity, based on previously entered data and other financial information important to you.

There is an address book, a list of organizations, and a personal diary that allows you to record reminders about events that are important to you.

The application is capable of keeping records in almost any given currency, performing scheduled calculation operations and printing data.

Databases are password protected for greater reliability and security of content.

Where did all the salary go? Who is to blame for money slipping through our fingers? How to get your personal finances in order? If you, like me, are concerned about these issues, it’s time to become your own accountant.

No, we will not study balances and holdings; we do not need to master reversal entries and currency clearing. Today's review includes 3 free programs for home accounting. All of them are intended for those who, like me, have absolutely no understanding of economics.

AceMoney Lite

– the “little brother” of a comprehensive personal finance management tool – the paid AceMoney application. Unlike the full version, Lite allows you to manage only two accounts, but for many of us this is enough.

An account in IceMoney is not only a bank card and a savings book, but also a collection of cash belonging to a family or one person.

Application features

- Management of personal cash flows in currencies of 150 countries.

- Track currency exchange rates in real time.

- Budget distribution for various needs: the application contains more than a hundred different expense items.

- Tracking regular income and expenses (salaries, rent payments, loan payments, replenishing your phone balance, etc.).

- Calculating expenses for specific purposes over a certain period of time. A couple of clicks and you will find out how much you spend monthly on groceries, how much on gasoline, etc.

- Generating reports on accounts, categories and correspondents (recipients of payments from you and those from whom you receive them).

- Export reports to Excel and html formats.

- Receiving information about the status of a bank account directly from the bank.

- Tracking the value of stock shares - for those who.

- Calculation of savings, debts, mortgages.

- Control using hot keys.

- Flexible settings, enabling or disabling individual elements and much more.

The program has a Russian-language reference manual plus on the developer’s website.

How to use AceMoney Lite

Working with AceMoney Lite begins with creating an account. To do this, click the button of the same name on the top panel and click “ Add account" We will indicate its name, group (for example, bank deposit, cash or loan), number (if any), bank name, interest rate, currency and other data that you need.

Next, enter information about replenishments and: click on its name and select “ New transaction"(record about an incoming or outgoing transaction). In the window " Transaction» We note its type (income, expense, transfer), correspondent, category (what you spent on - select from the list or write manually), date, number, amount and comment.

While in the same section, you can download transactions directly from the bank’s server, if the latter provides such services. You can balance multiple transactions.

Recurring transactions (salaries and regular payments) are added to the program through the “ Schedule" Click on the button “ Add payment"and indicate the parameters - frequency, duration, type (income, expense, transfer), source, correspondent, category, amount, etc. Regular transactions will be included in the list of transactions automatically.

The distribution of finances for various needs (budget) is made in the section “ Categories" Here we can select several predefined income and expense items (refueling the car, spending on food, etc.) or add our own. When creating and editing a category, you can set a different budget period, indicate expected income and expenses, as well as a limit.

In general, AceMoney Lite copes with its tasks very well. Users note that thanks to the program they were able to reduce monthly expenses by 10-30% and finally understand where the money goes. It has only one drawback, more precisely, the current version - 4.36: writing categories in English.

AbilityCash

At first glance, the program seems incomprehensible and unfriendly - the windows are nondescript and half-empty, there are no explanations, no help (not written yet). But if you spend 15-20 minutes studying, a lot of its advantages will open up. Many of those who have mastered AbilityCash consider it more convenient than AceMoney, and generally one of the best free programs for home accounting.

Key features of AbilityCash

- Creation of invoices without restrictions on quantity and in different currencies.

- Tree structure of income and expense items (you can add as many subcategories as you need).

- Import and export of data in xml and Excel formats.

- Download current exchange rates (optional).

- Drawing up and printing reports on exchange rates, fund balances and turnover dynamics.

- View transactions by income and expense items for a selected period of time.

- Support for Ukrainian and Lithuanian languages (selected during installation).

The following options are disabled by default:

- Tree structure and additional charts of accounts.

- Budget period in operations.

- Fields "Price", "Quantity" and "Time" in the list of transactions.

- Several comment fields that you can give your own name.

To activate any of this, go to the menu " File" and click " Data File Settings».

How to use

Using AbilityCash, like AceMoney, begins with creating accounts and indicating the current cash balances on them. To do this, open the first tab and press the “ Insert" In the window, enter the name of the account, select the currency and indicate the balance.

By default, AbilityCash has only one currency - Russian ruble. To install additional ones, press Ctrl+R and download the latest data from the website of the Central Bank of Russia. In the last window, select the currencies you want to display in the application.

To the section " Operations"(similar to AceMoney transactions) information about specific purchases, payments, receipts and transfers of money between accounts is entered.

To get summary data on the state of finances or exchange rates, open the tab " Reports».

AbilityCash is without a doubt a worthy tool for accounting for personal funds. And it would be even better with context-sensitive help, which the developers don't seem to remember, and a more user-friendly interface. However, there is a short version on the official website. There is also a place where you can ask a question if something is unclear, or report a problem.

Economy

The “” program is perhaps intended for those who are completely unfamiliar with accounting science and for whom the concepts of “transaction” and “investment” evoke deep melancholy. There is no scientific terminology in it and everything is so simple and clear that both a child of 10-12 years old and a person of advanced age can use it. The only limitation of the free version is that the total monthly income is no more than 14,000 rubles.

Application features

- Creation of any number of accounts and accounts, including currency ones.

- Maintaining records in the currencies of several countries.

- Separate items of expenses, income and debts for each user.

- Reminder function for regular payments and overdue loan (debt) payments.

- Creation of reports on several categories: fund balances, income over a period of time, debts and loans, expenses of each user for a given time period, income minus expenses.

- Filtering data for viewing.

- Automatic backup.

- Built-in Russian-language help.

- Go from the main menu to the developer's website.

To quickly master the program, you can download a demo file immediately after installation. It contains an example of budgeting for a family of two people.

How to use

First, let's create a user and link all his accounts to the account:

Maintaining home accounting is the success of maintaining wealth in the family. You can control your income and expenses the old fashioned way, i.e. in a notebook, and using modern methods, by installing the appropriate software on a PC.

In particular, we will consider the 5 most convenient and widespread programs for these purposes.

- HomeBank;

- Family Budget Lite;

- Family Accounting;

- CashFly;

- Home Accounting Lite.

HomeBank

A free application that allows you to keep track of your finances. Using the software, you can fully control your income and expenses, plan your family budget, analyze expenses and more. Take complete control of your spending.

The program supports tight integration and import of data from Microsoft Money and Quicken services, as well as other applications for managing your own funds. Supports QIF, QFX, CSV and OFX formats.

The functions include detection of duplicate transactions. This allows you to avoid confusion in calculations and clutter in the database.

Note! Transactions can be organized into categories. You can also schedule the automatic addition of incoming transactions to the created database, adding various tags and more. There is also a function that allows you to edit several fields at once, which significantly speeds up and simplifies the accounting process.

Set annual or monthly budget levels for each category as needed. Generate dynamic reporting that reflects the current state of your financial situation. If necessary, they can be provided with diagrams for clarity.

Family Budget Lite

This program is designed to relieve your pain in terms of counting personal expenses. All you have to do is enter your own income and expenses in the appropriate columns. The program will perform all other operations independently.

The client benefits are as follows:

- profitability for several main categories and accounts is taken into account;

- you can account for your own debts, loans, investments, deposits and other calculations;

- you can use the auto-category function, i.e. when entering product names, the program will automatically select the required category from the table;

- detailed report of 8 parts in one click;

- export to HTML, BMP, TXT, Word and Excel. It is also possible to print and save the document.

The client can be used by several people at the same time. In this case, everyone will have their own account and password. The latter can be installed when the application starts.

Searching for income and expenses is very convenient, since it is possible to customize the results using several filters at once: product, date, category, etc.

Accounting Family

If you don't want to systematically wonder where your money is constantly going, use this program.

You don’t have to speculate and remember where the money went, which was put aside for so long for an important purchase, but at a critical moment it took it and evaporated in the literal sense of the word.

The program will allow you not only to analyze, but also to control revenue. You will also be able to plan your own expenses by thinking through your budget more carefully. The client has enough options:

- accounting of income and expenses;

- accounting of debts (both borrowed and borrowed);

- analysis of financial transactions;

- Possibility of accounting in different currencies.

You are free to work in the program yourself, or give access to other users. Everyone will log in with their own credentials.

For security, archived copies of databases are provided, which can be saved for later restoration from the archive or uploaded to Excel/OpenOffice.

CashFly

CashFly is a simple and very user-friendly program for recording personal financial transactions. You can create multi-level structures displaying income and expense items.

It is also possible to build charts of varying degrees of complexity, based on previously entered data and other financial information important to you.

There is an address book, a list of organizations, and a personal diary that allows you to record reminders about events that are important to you.

The application is capable of keeping records in almost any given currency, performing scheduled calculation operations and printing data. Databases are password protected for greater reliability and security of content.

Note! You can make your entries in several currencies without being tied to any specific unit of account. If several people use the application at the same time, entries are entered independently, since they are logged in under different accounts.

The program interface is in Russian. It is intuitive even for beginners. It is possible to adjust the interface to the needs of a specific user. A special help system is provided to resolve questions.

As you can see, home accounting is possible not only on paper.

Now, in order to store several records and not get confused in the calculations, you just need to install one of the applications, create your account and start making calculations, systematizing the total profitability and other financial transactions.

This is much more convenient than spending many hours calculating expenses on a calculator and then filling out tables. And it is much more difficult to make mistakes in calculations, since the system will warn about possible duplicate data.

If you are one of those people for whom every penny spent is important, then most likely you will be interested in this a selection of mobile applications for home accounting and personal finance on Android. With the help of these applications, you can easily manage your income and expenses, make a plan, see the result in the idea of graphs and sort the money spent by category.

Today's review of the most popular home accounting applications includes: AndroMoney, Expense Manager, “Family Budget”, EasyMoney, CoinKeeper And "Home accounting".

AndroMoney

- Category: Finance

- Developer: AndroMoney

- Version: 2.7.12

- Price: Free - Google Play

- Pro version for $5 – Google Play

AndroMoney– a multifunctional application for maintaining “home accounting” for Android. According to the developers, when creating this application, they wanted to make it with an intuitive interface, a huge number of different settings and additional functions that would help in the daily management of user expenses and income. It's safe to say that they succeeded.

Thanks to the wide functionality, every user will be able to find suitable reporting tools for themselves. A distinctive feature of this application is the fact that it allows you to set a budget for one day, month, year, or a separate budget for a selected category.

In addition to all that has been said, the AndroMoney application can create backup copies of your accounting records, saving them both to a memory card and to cloud storage Dropbox or Google Drive. Also, if desired, each user will be able to save their report in CVS format and continue working with it on a personal computer.

pros:

- Convenient, intuitive interface;

- Wide functionality and many additional settings;

- Data backup;

- Convert to CVS format for further work on a PC;

- Password protection and much more.

Minuses:

- During testing of the application, no cons were found.

Expense Manager

- Category: Finance

- Developer: Bishinews

- Version: 2.0.5

- Price: Free - Google Play

- Pro version for $5 – Google Play

Expense Manager– there are currently several applications with a similar name on Google Play, but it is the application developed by Bishinews that, according to users, is the most popular and popular. This can be judged by the download counter in Google Play, which just recently reached 5 000 000 downloads.

The functionality of the application is huge, but the most important thing is planning your finances. Yes, the developers did not provide the program with a Russian interface, but in principle it is not needed, because everything here is clear and convenient. Initially, when we enter the program, we will see a template with several expense items, which, if desired, can be changed by going to the settings. You can also very easily view the required payments or look at a detailed and visual expense schedule.

Like AndroMoney, this application can easily backup your reports to Dropbox cloud storage or your device’s memory card. A distinctive feature of this application is the presence of a built-in currency converter, which, by the way, only works if there is an Internet connection.

In the Google Play app store, this program is available in two versions: a free version and a full version, which can be purchased for $5, but with wider functionality

pros:

- Convenient minimalist interface;

- Many useful functions;

- View reports in graph idea;

- Data backup;

- Currency converter (only if you have an Internet connection).

Minuses:

- Limited functionality of the free version;

- Russian language is missing

"Family budget"

Developer: maloi

Version: 2.1.11

"Family budget"- an official mobile client for Android that exactly replicates the functionality of one of the popular web services for accounting. The developers claim that their service is the most convenient for planning expenses, and will also easily allow you to monitor the family budget and spend money more efficiently.

The application turned out to be no less simple and convenient, making it quite simple and convenient to use, and the presence of huge functionality allows you to easily monitor the financial affairs of your family directly from your phone or tablet.

Each generated report can be viewed in the form of graphs that more clearly display all the necessary information on cash expenditures. The application interface turned out to be quite convenient; there are no unnecessary elements or unnecessary functions. A convenient feature of this service is automatic synchronization with an Android device, which allows you to quickly and comfortably transfer data entered on the site using a PC to a mobile device and vice versa.

pros:

- User-friendly interface;

- Maximum settings;

- Synchronization with the service;

- Visual display of reports in the idea of graphs.

- There is a “desktop” version of the service

- Category: Finance

- Developer: Handy Apps Inc

- Version: Depends on device

- Price: Free - Google Play

- Pro version for $10 – Google Play

EasyMoney– the most expensive and most functional application in this category of applications. But judging by the number of downloads in Google Play The price of the application does not stop users at all, especially since there is a free version of the program and you can test the initial functionality on it, and only then decide whether it is worth spending money on this program or not.

Of all the functionality that the program has, I would like to note such features as: displaying interactive reports and charts, maintaining several accounts in foreign currency, maintaining a home budget and tracking investments and plastic card balances.

With the data backup feature, you don't have to worry about saving your reports safely. You can easily transfer all the work done to a memory card or export reports in format QIF (CSV).

pros:

- Huge functionality;

- Visual reports in the form of interactive graphs;

- Transferring ready-made answers to a memory card;

- Availability of a convenient widget.

Minuses:

- Not entirely clear interface;

- Lack of Russian language;

- High cost for the full version of the program.

CoinKeeper

- Category: Finance

- Developer: IQT Ltd

- Version: 1.5.3

- Price: Free for the first 15 days - Google Play

"Home accounting"

- Category: Finance

- Developer: Keepsoft

- Version: 5.2.128

- Price: 4$ – Google Play

Bottom line:

Surely each of us cannot imagine life in the modern world without mobile devices. After all, with their help you can solve many important problems, for example, making a shopping list, listening to the radio on the road, and other equally interesting tasks that modern gadgets can do.

In today's review, each of the applications deserves your attention; the functionality of almost each application is unique and may be needed by different types of users. I made my choice in favor CoinKeeper, and which application is best for you is up to you to decide, of course.